Says Nikkei, Tokyo based world’s largest financial publication and who runs the index for Tokyo Stock Exchange after stripping down a Model 3. This is no little gap in consideration with today’s market and manufacturing terms.

Looking back, in the wake of the auto industry collapse in 2010, Toyota partnered with Tesla to incorporate its battery technology into future Toyota cars and SUVs. Tesla was seeing success in a very niche market with its Tesla Roadster, so it seemed like a safe bet for the Japanese company to bring it to the mainstream.

Four years and one spectacularly failed vehicle later, Toyota abandoned developing pure electric vehicles (The RAV4 pictured above) in favor of hydrogen fuel cells.

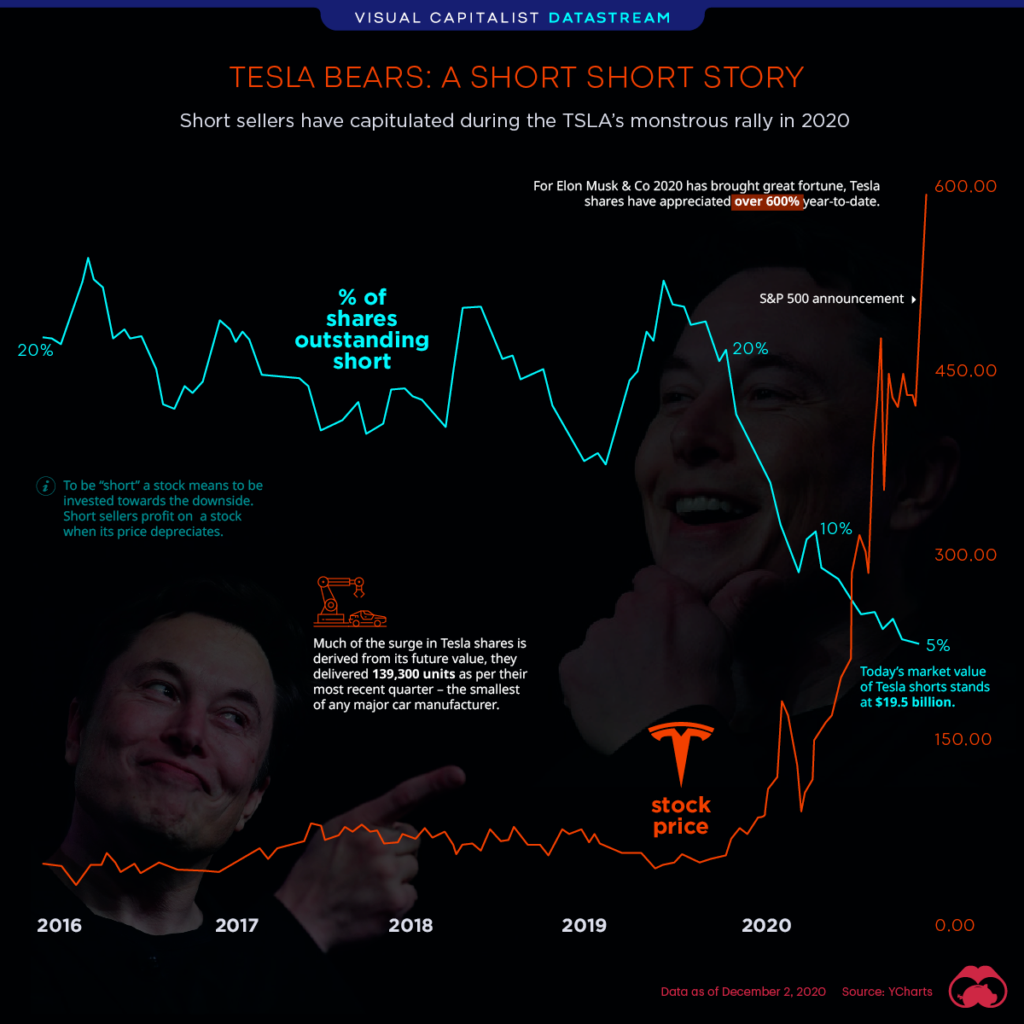

As of now (2019) Toyota and Volkswagen each sell 10 million cars a year. Tesla delivered only about 367,500 in 2019. But not only with the electronics technology; sourcing, logistics, and even in business modeling Elon Musk’s young company is far ahead of the industry giants.

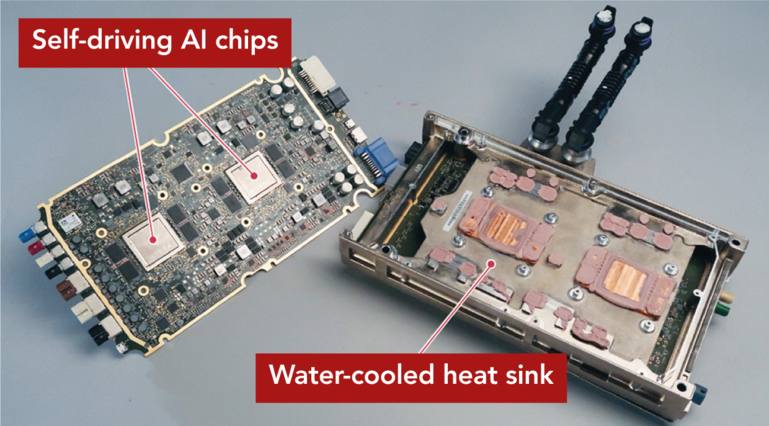

What stands out most is Tesla’s integrated central control unit, which is a “full self-driving computer.” This is now known as Hardware 3, the small printed board which is a deciding weapon in the booming EV market. It could revolutionize the industry supply chain as they say.

Japs cannot do it!

One stunned engineer from a major Japanese car-maker examined the computer and said, “We cannot do it.”

This module is in all-new Model 3, Model S, and Model X vehicles include two custom, 260-sq.-mm AI chips. Tesla developed the chips on its own, embedded with its software to complement the hardware. This computer powers the cars’ self-driving capabilities as well as their advanced in-car infotainment system.

The Model 3’s “full self-driving computer” consists of two boards: one with custom AI chips for autonomous driving, and a media control unit for the “infotainment” system. A water-cooled heat sink is installed between the two boards. (Source – Nikkei xTech)

It’s all about handling heavy loads of data, industry insiders say such technology to come up with others only around 2025 at the earliest.

That means Tesla beat its rivals by six years and keeps improving, tough to catch!

This raises goosebumps with other automakers.

Tesla built this digital platform with a series of upgrades to the original Autopilot system it introduced in 2014. What was also called Hardware 1 was a driver-assistance system that allowed the car to follow others, mostly on highways, and automatically steer in a lane.

Tesla too improves

Year by year, they pushed the offering further, culminating in the full self-driving computer. And funds came their way too, in beating the cash-rich Toyota!

Toyota or VW will be able to do such developments with their immense financial resources and vast talent pools, earliest will be by 2025. But technological hurdles are not the reason for the delay, according to the Japanese engineer who said: “We cannot do it.”

The real reason for these delays is the computers like Tesla’s will obsolete the parts supply chains others have cultivated over decades, the engineer said.

These technologies will drastically cut the number of electronic control units, or ECUs, in cars. For suppliers that depend on these components, and their employees, this is a matter of life and death.

Big automakers apparently feel obliged to continue using complicated webs of dozens of ECUs, while we only found a few in the Model 3. simply the supply chains that have helped today’s auto giants grow are now beginning to hamper their ability to innovate.

Supply chains

Furthermore, young companies like Tesla are not relying on suppliers and are free to pursue the best technologies available. Musk’s company has seen going strong on both backward and forward integration, completely different to traditional car-makers.

Most parts inside the Model 3 have no supplier brand name like we see today with Bosch, Denso, KYB, and the likes. But the Tesla logo, including the components inside the ECUs. Tesla has the toughest control over the development of almost all key technologies in the car.

What’s more frightening to Toyota and VW likes is Teslas can evolve through “over the air” software updates. This eliminates the visit to a dealership and dealership revenue too.

Dealership biz model

This is even more frightening to traditional automakers who operate on a dealership-based business model, where Tesla sells to the end customer directly eliminating the middle man with a minimum of 10% retail price and massive after-sales revenue.

Tesla’s are still classified as Level 2 or “partially autonomous” cars. But Musk has stressed that they have all the necessary components — “computer and otherwise” — for full self-driving.

From software to drive trains, Tesla is continuously bringing more development tasks within their control. Competitors will have little or no choice but to follow Tesla’s leaving their outdated technology and old business models.

Not only on the tech front, but Big and old makes are also largely missing in the marketing models too.

Some info and pics are of the courtesy of Nikkei Asian Review

T

T

Sign up with us for the latest news and trends in mobility.